How Much Can I Get Back in Customs Fees for a Return?

If you’re thinking about returning an item to the retailer abroad, you’re probably wondering whether you can reclaim customs charges, and in that case – how much money can you get back?

Usually, any item over £135 is eligible for a refund of import duty and VAT if returned abroad. There are a few exceptions to this, which we’ve outlined below.

Read on for a comprehensive look at post-Brexit customs rules. We’ll also outline how to calculate and receive a refund of customs charges in three to six weeks.

How Brexit changed customs rules in the UK

Quite a few things have changed since the UK stopped being an EU member state – including customs rules.

The change was implemented on January 1, 2021.

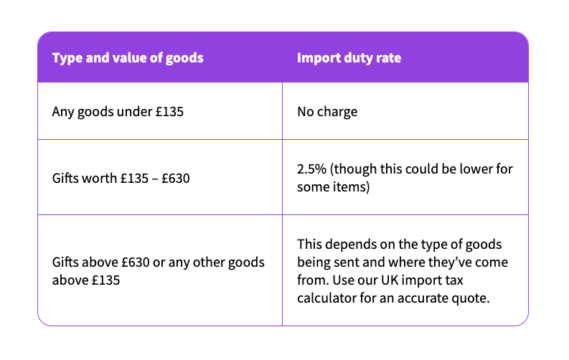

When you order items worth over £135 from abroad, in addition to the order itself and any shipping costs, you may also be charged:

- Customs duty

- Import VAT

- Handling fees

What you are charged depends on where the item is produced and where it is being shipped from. For example, you don’t need to pay customs duty on items of EU origin, but you do need to pay customs duty if the item was produced outside the EU but sent from the EU.

Are all customs charges refundable?

Not all customs charges are refundable – only import duty and import VAT are.

Import duty is a tariff or a tax on goods imported to the UK. It is also known as customs duty, and this tariff applies to:

- Goods imported from any country outside the EU

- Goods shipped from an EU member state but originating abroad.

It is not a fixed rate. The rate depends on the value, type, and origin of the imported item. You don’t have to pay it if:

- The goods were made in the EU;

- The parcel contains gifts worth less than £39

- The goods are valued at under £135.

Import tax, or import VAT (value-added tax), is a tariff on goods bought outside the UK borders.

The usual rate of import VAT is 20% of the total cost of the goods (including shipping). However, it can sometimes be higher depending on what you’ve purchased.

And if someone sends you a gift from abroad, you should be aware that import taxes are applied if the value of the gift is over £39.

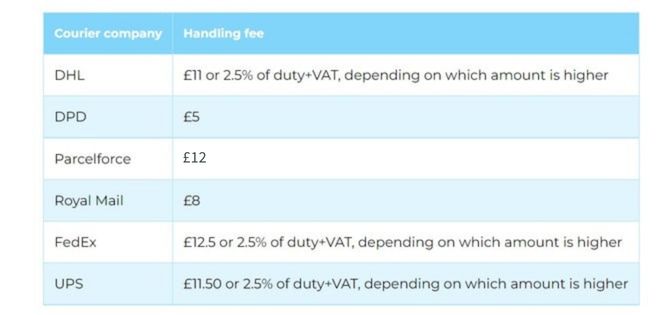

Courier handler fees

When you order something from abroad, it’s delivered to you by a courier company like Parcelforce or DPD.

The courier is the one that handles customs procedure and payments on your behalf.

But as compensation for their services, they usually charge a handling fee, which is non-refundable. It’s also important to note that each courier company charges differently for customs handling. These are the costs you should expect as of March 2023:

Excise duty

Excise duty is taxed on certain goods like alcohol or tobacco. Different rates apply and can not be reclaimed. The tax is in place to limit the use of products damaging to health and the environment.

Who is eligible for a refund of customs duties and VAT?

UK citizens and permanent residents who have returned an item abroad worth over £135 are eligible to claim a duty refund and VAT return – as long as it hasn’t been more than 365 days since the return.

There are some specific situations when you can also get these fees refunded, as long as the value of the return exceeds £135. Here they are:

- You’ve sent back the goods to the seller but only received one part of the refund.

- You’ve sent only one of the ordered items to the retailer.

- You didn’t ship the items back, but the retailer gave you back the money for your order.

- You’ve already paid the taxes for the goods you’ve never received, but the retailer still issues you a refund.

If you’re still unsure whether you’re eligible for a refund of customs charges, don’t hesitate to message us. We’re really happy to help.

How much in customs duty can I reclaim?

If you return an item worth over £135 to a seller abroad, you should be entitled to a full refund of import duty and VAT on that item (again, there are a few exceptions). If you’re returning only part of your order, you will be refunded proportionally to the value of the return.

We always recommend saving your courier receipt. It should have all the information about customs charges related to your order. It will come in handy if you do have to return something.

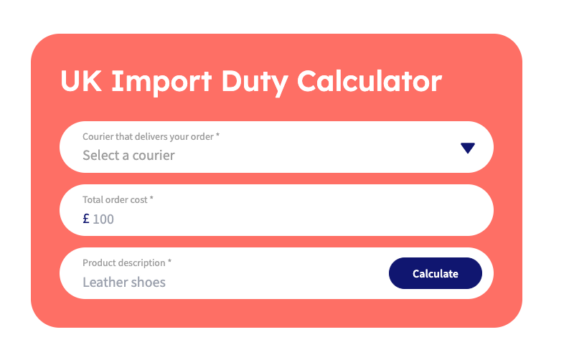

But to make this process easier, you can always use our import duty calculator, which will give you an estimate of the customs charges you paid in seconds.

Just enter the cost of your purchase, a brief product description, and the courier company that delivered your parcel.

You will get an estimate of what you’re owed based on your provided data.

When you’re ready, you can start your Duty Refund claim.

You have two options:

You can either claim through HMRC directly, or you can have Duty Refunds do it for you.

Reclaiming import charges with Duty Refunds

Duty Refunds’ mission is to help UK citizens reclaim customs charges for international returns quickly and without hassle. Our service is efficient, transparent, and zero risk for you.

We have a simple four-step process. To get started, all you need to do is to fill out our online form to confirm your eligibility.

We will ask you to give us your tracking number and upload your delivery documents. In case you don’t have them, it’s no problem. We can liaise with all major courier companies and HMRC to collect everything we need to ensure that the entire process runs smoothly.

From there, we need you to sign a letter giving us permission to act on your behalf with HMRC.

It usually takes us around five weeks to get your refund. When HMRC approves the claim, we’ll contact you for details on the account you want your refund to be sent to.

Our fee is a flat 15% of the total amount of your refund. This is taken out automatically when we transfer over the refund. If your claim is not approved, you don’t pay a penny.

Key takeaways

So what can you take away from this article?

Firstly, you can claim your import duty refund after returning the goods to the retailer.

You can use Duty Refunds calculator to calculate how much you can stand to receive back.

And finally, the whole process of claiming your refund can be a breeze, thanks to Duty Refunds!

At Duty Refunds, we pride ourselves on our high success rate in securing refunds for our customers. We have a team of experienced professionals who know the ins and outs of the process, and we’re dedicated to getting our clients the money they’re owed.

But don’t just take our word for it – take a look at what some of our satisfied customers have to say about Duty Refunds on TrustPilot.

The only thing keeping you from getting your money back is filling out our new claim form!